With BlueStone’s IPO closing with 2.7X subscription last week, the omnichannel jewellery brand’s early investors are set to make big returns on their investments.

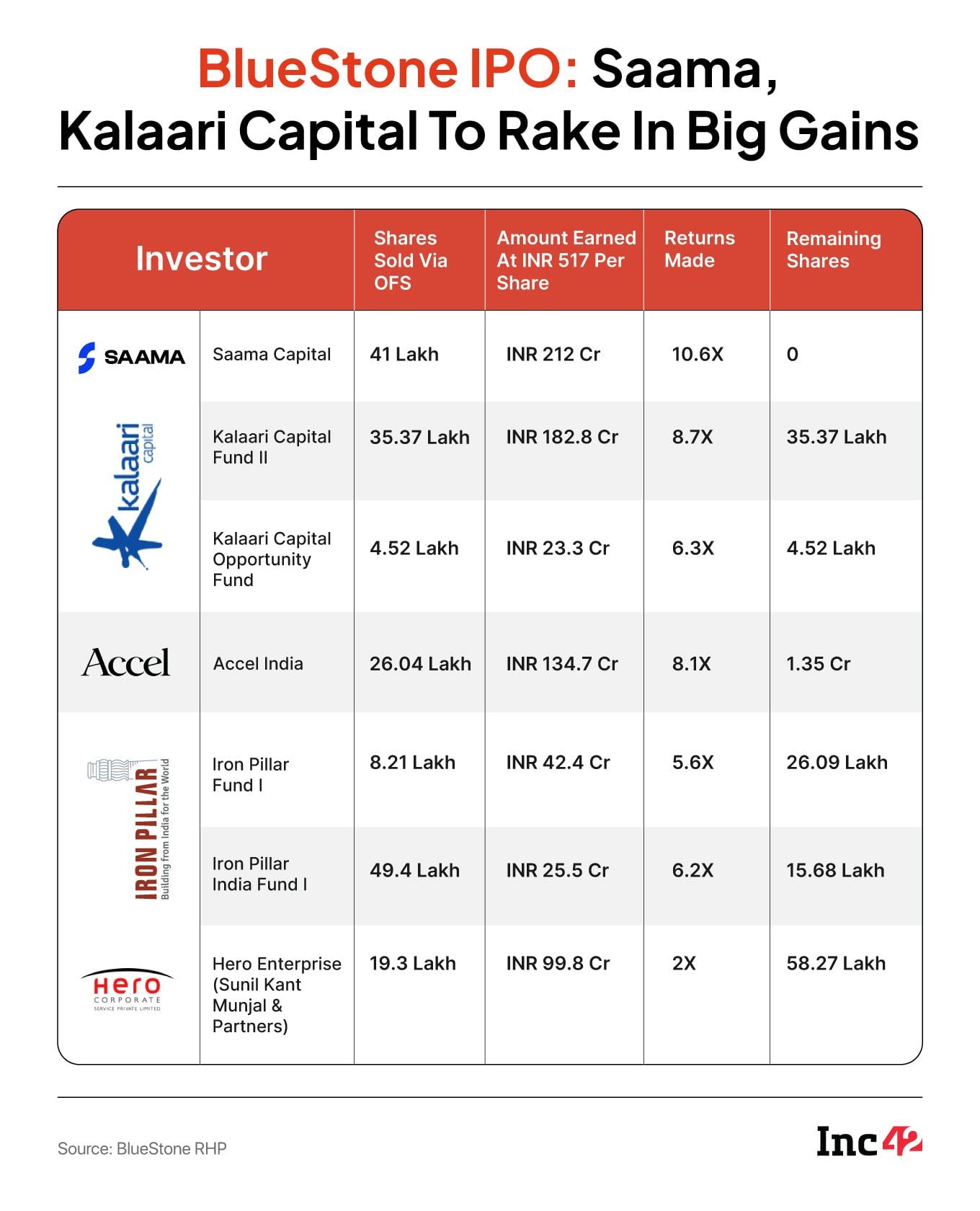

VC firm Saama Capital, which is exiting the company by selling 41 Lakh shares via the OFS, is set to rake in over 10X returns on its investments at the upper end of BlueStone’s IPO price band of INR 492 to INR 517. The investor had bought these shares at INR 48.7 apiece, translating to 10.6X returns.

Saama Capital first invested in BlueStone during its Series A funding round in 2012, along with Accel.

Accel India will net about INR 134.7 Cr, or a return of nearly 8.1X, by selling shares in the OFS. The VC firm is offloading 26 Lakh shares, which it acquired at INR 63.68 apiece.

BlueStone’s IPO comprised a fresh issue of shares worth up to INR 1,000 Cr and an OFS of up to 2.4 Cr shares by existing investors, setting the stage for some of its earliest backers to book multifold returns. The company’s shares are set to list on the bourses tomorrow.

Kalaari Capital, which held shares in the company via two funds, is selling nearly 40 Lakh shares via the OFS. It is offloading 35 Lakh shares, held via fund II, which were acquired at an average cost of INR 59.28 each. At INR 517, it would net INR 182.8 Cr from this. Meanwhile, Kalaari Capital Partners Opportunity Fund is set to sell 4.5 Lakh shares, securing 6.3X returns.

Overall, Kalaari will get INR 206.3 Cr from the IPO, and will continue to hold about 40 Lakh shares of the company.

VC firm Iron Pillar is also selling about 13.15 Lakh via two funds. Together, it would net INR 67.9 Cr by selling the shares at INR 517, translating to an average return of 5.6X.

Hero Enterprise chairman Sunil Kant Munjal and partners from Hero Enterprise Partner Ventures are selling 19.3 Lakh shares, acquired at INR 262.76 each, in the OFS. This would translate to INR 99.8 Cr at the upper end of the price band, bringing in near 2X returns. Notably, founder and promoter Gaurav Singh Kushwaha is not selling any stake in the OFS.

BlueStone IPOFounded in 2011 by Kushwaha, BlueStone has grown from an online-only fine jewellery platform into a vertically integrated omni-channel brand with over 200 stores across India.

BlueStone’s public issue comes at a time when branded jewellery retail in India is witnessing rapid premiumisation, with consumers shifting towards organised players. The company’s revenue growth in recent years has been driven both by new store openings and improving same-store sales, although profitability remains under watch as expansion costs weigh on margins.

The INR 1,000 Cr fresh issue proceeds are earmarked for store network expansion, working capital, technology upgrades, brand building, and general corporate purposes.

BlueStone’s net loss widened 56% to INR 221.8 Cr in FY25 from INR 142.2 Cr in the previous year. Its operating revenue zoomed 39.9% to INR 1,770 Cr during the year from INR 1,265.8 Cr in FY24.

About 93% of its revenue comes from offline sales in FY25, on the back of rising offline store counts. The company relies heavily on studded jewellery, which accounted for about 67.8% of its total revenue in FY25.

The post BlueStone IPO: Saama To Exit With 10.6X Returns, Accel To Rake In 135 Cr appeared first on Inc42 Media.

You may also like

'Without requesting any amendments': Hamas accepts new Gaza truce plan; hostages to be freed in batches

Made in Chelsea's Tiffany Watson opens up on mum guilt and being in 'no rush to bounce back'

Jennifer Aniston's smart workout routine keeps her 'incredibly strong' at 56. Her unconventional fitness and diet secrets may surprise you

Mumbai News: NCLT Declares Ex-DHFL Promoter Kapil Wadhawan Bankrupt Over ₹39,000 Crore Debt To Union Bank

Yoane Wissa goes nuclear and takes drastic action to force £35m Newcastle move